For most Americans, the term “credit score” brings a mix of confusion, anxiety, and frustration. You might check your score on a free app and wonder, why did it drop 20 points?, or hear your bank say, “We can’t approve the loan because your score is too low.” But what actually goes into a credit score? And more importantly — how do you improve it?

This guide breaks it all down in plain, simple terms. Whether you’re just starting your financial journey or trying to bounce back after a few credit mistakes, here’s what you need to know to take control of your credit score in the U.S.

What Is a Credit Score?

A credit score is a three-digit number — usually between 300 and 850 — that represents your creditworthiness. In simple words, it’s a number that lenders use to decide how risky it is to lend you money.

The higher your score, the more trustworthy you appear:

- 740–850 = Excellent

- 670–739 = Good

- 580–669 = Fair

- 300–579 = Poor

A higher score can get you:

- Lower interest rates on loans and credit cards

- Easier approval for rentals and mortgages

- Better insurance premiums

- Access to higher credit limits

Who Calculates Your Credit Score?

In the U.S., your credit score is calculated by private companies called credit bureaus. The three major ones are:

- Experian

- Equifax

- TransUnion

These bureaus collect your financial data and send it to scoring models like FICO (used by 90% of lenders) or VantageScore.

Each model has its own formula, but they mostly rely on the same five categories.

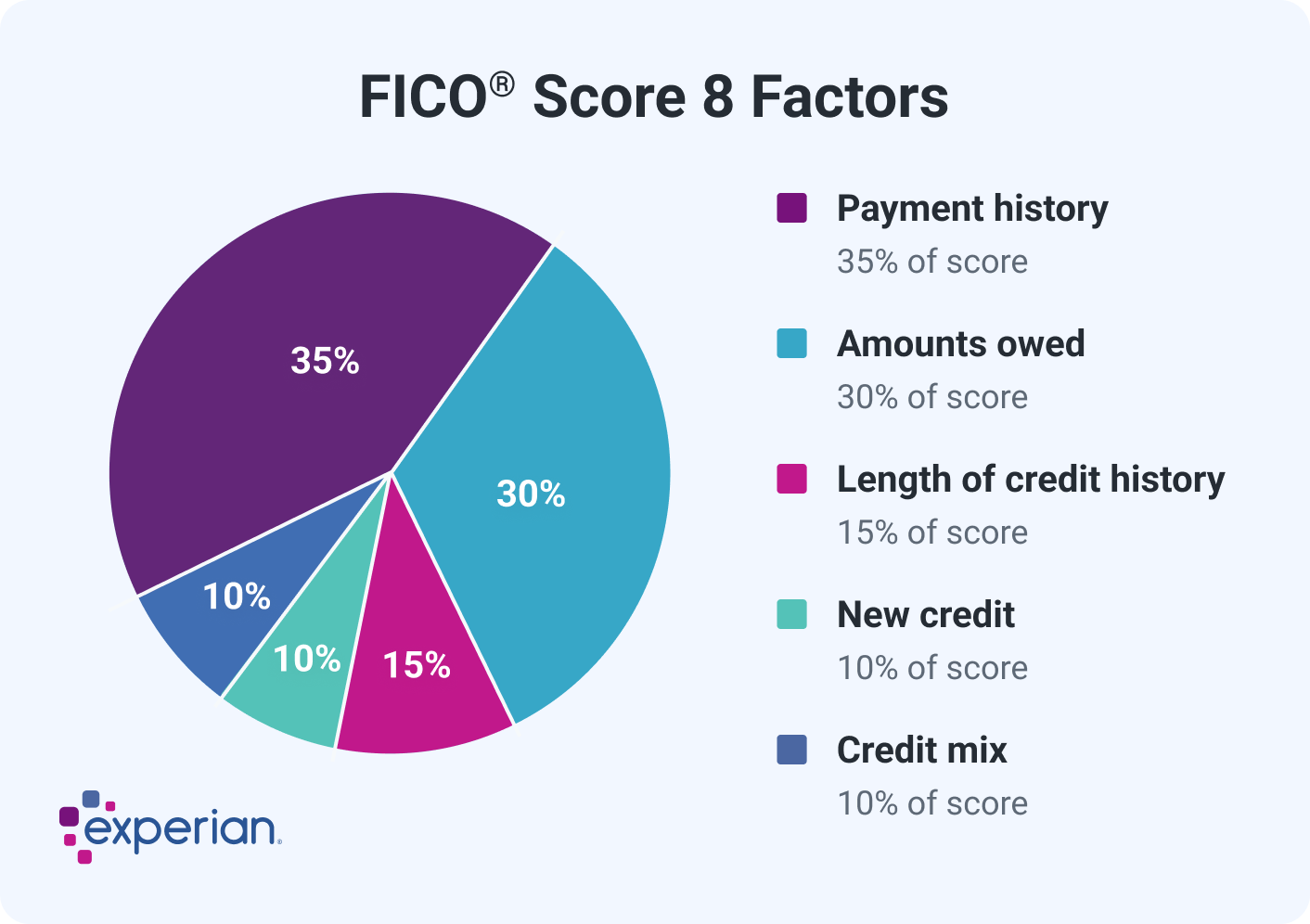

The 5 Key Factors That Affect Your Credit Score

Payment History (35%)

This is the most important factor.

Lenders want to know: Do you pay your bills on time?

What counts:

- Credit card payments

- Loan EMIs

- Mortgage, auto, and student loan payments

- Any account that reports to the credit bureaus

One late payment (30+ days overdue) can drop your score by 50–100 points.

Tip: Set up automatic payments or reminders so you never miss a due date.

2. Credit Utilization (30%)

This is the percentage of your available credit that you’re using.

Formula:(Total credit card balances / Total credit limits) x 100

Example:

- If you have a $1,000 limit and owe $300, your utilization is 30%.

High utilization signals financial stress to lenders — even if you pay on time.

Tip: Keep your utilization below 30%, and ideally under 10% for top scores.

Length of Credit History (15%)

How long have you been using credit?

Factors include:

- Age of your oldest account

- Age of your newest account

- Average age of all accounts

Longer history = more data for lenders to trust.

Tip: Don’t close old credit cards unless necessary. Even a card you rarely use can help your score by increasing your credit age.

Credit Mix (10%)

This refers to the variety of credit accounts you have.

Types include:

- Credit cards

- Auto loans

- Student loans

- Personal loans

- Mortgages

Lenders like to see that you can handle both revolving credit (like credit cards) and installment loans (like car payments).

Tip: Don’t take on debt just to improve mix — but if you’re ready for a loan, it can help diversify your profile.

5. New Credit Inquiries (10%)

Every time you apply for new credit, the lender performs a “hard inquiry” — and that can temporarily lower your score.

Too many applications in a short time looks risky.

Tip: Space out your applications, and avoid applying for multiple cards or loans at once unless you’re rate shopping (e.g., for a mortgage or auto loan, where multiple inquiries within 14–45 days may count as one).

Common Credit Score Myths (and Truths)

Myth: Checking your own score hurts it

Truth: This is a soft inquiry and has no effect.

Myth: Carrying a balance helps your score

Truth: You should pay off your balance in full each month. Carrying debt increases utilization and interest charges.

Myth: Closing unused cards boosts your score

Truth: It usually hurts your score by reducing your available credit and average account age.

Myth: Income affects your credit score

Truth: Your income isn’t part of your score. But it may affect whether you’re approved for a credit product.

How to Improve Your Credit Score

If your score needs a boost, here are the most effective steps:

- Always pay on time. Even one late payment can hurt.

- Pay down credit card balances — especially high utilization cards.

- Ask for a credit limit increase (only if you can resist spending more).

- Become an authorized user on someone else’s old, good-standing credit card.

- Dispute any errors on your credit report with the bureaus.

- Use tools like Experian Boost to add utility and rent payments to your profile.

How to Check Your Credit Score for Free

You’re entitled to one free credit report per year from each bureau. Visit:

AnnualCreditReport.com — the only official site.

For free credit score tracking:

- Credit Karma (TransUnion & Equifax)

- Credit Sesame

- Discover’s Free Credit Scorecard

- Your bank or credit card provider

Final Thoughts

Your credit score isn’t a judgment on your character. It’s just a tool lenders use to evaluate risk. And like any tool, you can learn to manage it.

Improving your score isn’t about tricks — it’s about consistency:

- Pay bills on time.

- Keep balances low.

- Be patient.

With time, even a poor score can become excellent. And once it does, it opens the door to better rates, more freedom, and a lot less financial stress.